Starting an online business in Texas can be an exciting and rewarding endeavor.

With the internet providing access to customers across Texas, the US, and even globally, the potential opportunities are immense.

However, launching an online business also requires research, planning, and preparation.

Following key steps can set your Texas online business up for success.

This guide will walk you through the major steps and considerations when starting an internet-based business in Texas. We’ll cover:

- Determining the legal business structure

- Registering your business

- Obtaining necessary licenses and permits

- Setting up accounting, tax, and legal compliance

- Building your website and online presence

- Marketing and promoting your business effectively

Whether you’re looking to sell products, offer consulting services, build an ecommerce store, or monetize a blog or YouTube channel, this guide applies.

We’ll provide tips and resources specifically for launching and growing an online business in Texas.

With careful planning and by leveraging the immense reach of the internet, a successful and profitable online business is possible right from the Lone Star State.

So let’s get started!

Top 10 Online Business Ideas You Can Start in Texas

Before you start an online business in Texas, you need an idea!

Here are the top 10 online business ideas you can launch right from Texas:

1. E-commerce Store

With its large population and central location, Texas is a great place to base an e-commerce store.

You can choose a specific niche or offer a range of products across categories.

Popular platforms for setting up your online store include:

- OLITT: Offers unlimited product uploads

- Shopify: User-friendly, powerful platform

- BigCommerce: Great for scaling larger businesses

- WooCommerce: If you already use WordPress this is a perfect solution

2. Dropshipping

Dropshipping eliminates the need for inventory management. Simply partner with suppliers and list their products on your website. Customers’ orders are fulfilled directly by the supplier.

Is dropshipping legal in Texas?

Yes, dropshipping itself is legal in Texas. However, there are important tax and business considerations to keep in mind:

Sales Tax and Nexus

- Nexus: If your dropshipping business has a physical presence in Texas (e.g., an office, warehouse, employees), you’ll likely have nexus in the state. This means you have the obligation to collect and remit sales tax to the Texas Comptroller’s Office.

- Retailer Responsibility: Texas has relatively relaxed rules for dropshippers. The sales tax responsibility primarily falls on the retailer (your business), not the dropshipping supplier.

- Out-Of-State Suppliers: If your dropshipping supplier is located outside of Texas and ships directly to Texas customers, you’ll still likely need to collect sales tax even if you don’t have a physical presence in the state (this relates to economic nexus rules).

Business Registration

- Business Structure: While you don’t technically need a business license to start dropshipping in Texas, it’s highly recommended to register your business as an LLC or a sole proprietorship for liability protection and tax benefits.

- EIN: You’ll likely need an Employer Identification Number (EIN) from the IRS, even if you don’t have employees. This is used for tax filing and for opening business bank accounts.

Key Points to Remember:

- Even though Texas has fairly relaxed rules for dropshippers, the burden of handling sales tax correctly falls on you as the retailer.

- Sales tax laws can be complex, and it’s crucial to understand your obligations regarding collection and remittance.

- Texas may have specific rules for certain types of products. Do your research if you’re selling in regulated categories.

3. Freelance Services

Offer your skills online – whether you’re a writer, graphic designer, website developer, or have other marketable talents.

Freelance platforms make it easy to find work:

- Upwork: Popular platform with vast project options

- Fiverr: Geared towards quick, well-defined gigs

- Toptal: Specializes in top-tier freelance talent

4. Blogging

Create content around a passion or area of expertise on your own blog.

Monetize through advertising, affiliate marketing, or selling your own products/services.

5. Affiliate Marketing

Promote other businesses’ products/services and earn commission on sales.

You can do this through your blog, social media, or a dedicated affiliate website.

6. Online Courses

Package your knowledge or skills into online courses.

Use platforms like Teachable or Udemy to host and sell your courses.

7. Virtual Assistant Services

Provide administrative, technical, or creative support to remote clients.

Virtual assistants manage tasks like scheduling, email management, and social media.

8. Social Media Management

Businesses often turn to experts to manage their social media presence.

Offer services like content creation, posting, and community engagement.

9. Web Design and Development

If you have the skills, help businesses build or improve their online presence.

Many small businesses in Texas would prefer to work with local web designers.

10. Online Consulting

Leverage your expertise to provide online consulting in areas like marketing, business strategy, or finance.

Target smaller businesses that could benefit from your help but can’t afford larger consulting firms.

Important Additional Notes:

- Find Your Niche: Succeeding in a crowded online marketplace often means zeroing in on a specific niche or target audience.

- Understand Texas Advantages: Research local grants or programs designed to support Texas-based businesses.

- Build Your Online Presence: Whether focusing on social media, your website, or both, a strong online presence is key to attract clients or customers.

Step 1: Determine Your Business Structure

One of the first key steps when starting an online business in Texas is determining the legal structure you will operate under.

The business structure you choose impacts taxes, liability, operation costs, and other factors. Here are some top options to consider:

Sole Proprietorship

A sole proprietorship is the simplest business structure.

There is no legal distinction between you and the business – you own and operate the business yourself.

Some benefits include:

- Easy and inexpensive to set up

- You retain complete control over all decisions

- Minimal legal compliance requirements

However, the downside is you have unlimited personal liability for debts and obligations related to the business.

This risk should be strongly considered.

Partnership

A partnership involves two or more individuals operating a business together.

Partnerships allow collaborators to contribute different skills and resources. Some key aspects:

- Written partnership agreement recommended to define ownership stakes, responsibilities, profit/loss distribution and other details

- Partners are jointly liable for financial obligations and debts

- Setting up a partnership still relatively easy and inexpensive

Limited Liability Company (LLC)

An increasingly popular choice, setting up an LLC separates your personal assets from those of the business. Key LLC features:

- Personal assets protected from business debts and claims unless personal guarantees made

- Profits pass directly to owners avoiding corporate double taxation

- Owners have flexibility in structuring company management and distribution of ownership percentages

Forming an LLC costs more than sole proprietorships but offers liability protections.

TLDR: Weigh factors like liability exposure, taxes, management flexibility and costs when determining which business structure is best for your Texas online business.

Step 2: Register Your Business

Once you determine the optimal business structure, formally registering your online business in Texas is an essential next step.

Properly completing registration protects your business name and also makes your business legal from an operational perspective.

Do I have to register an online business in Texas?

Here’s the breakdown of whether you need to register your online business in Texas:

Business Structure:

- Sole Proprietorship: If you’re operating your online business under your own legal name, no formal registration with the state of Texas is needed. However, you may need to file a DBA (Doing Business As) with your county if you operate under a different business name.

- LLC (Limited Liability Company): Yes, you must register your LLC with the Texas Secretary of State to have the legal protection and benefits of an LLC structure.

- Other Corporations: Similarly, if you’re setting up as a corporation or partnership, you must register with the Secretary of State.

Local/City Ordinances:

- Even if state-level registration isn’t necessary, always check with your local city and county for any specific business licenses or permits required for your type of online business activity.

Sales Tax:

- Texas requires that you get a Sales and Use Tax Permit if you sell taxable goods or services to Texas customers.

Why Register? (Even if not always required):

- Business Name Protection: Registering your business name (even as a sole proprietor) provides some protection against others using the same name.

- Professionalism: It presents a more established and professional image to clients or customers.

- Business Banking: Most banks require a formal business registration to open a business bank account.

Obtain Your EIN

Also referred to as a Federal Tax ID Number, an EIN is essentially the social security number for your business. It identifies your business for tax and reporting purposes.

- Acquire your EIN by submitting Form SS-4 to the IRS

- Having an EIN is necessary to open business bank accounts and apply for any licenses/permits

Register Your Business Name

Registering your business name distinguishes your business from others in Texas.

It also offers legal protections.

You must register if you will be operating under anything other than your full personal name. Some tips when registering your business:

- Search the Texas Business Organizations Database to ensure another entity does not already use the name

- Determine any doing business as (DBA) name registration requirements based on your business structure and location

- For corporations or LLCs, registration happens during formal company formation process

- For sole proprietors, general or limited partnerships, file for your DBA with your county clerk’s office

Properly registering your business name prevents future conflicts and shows you operate a valid legal business.

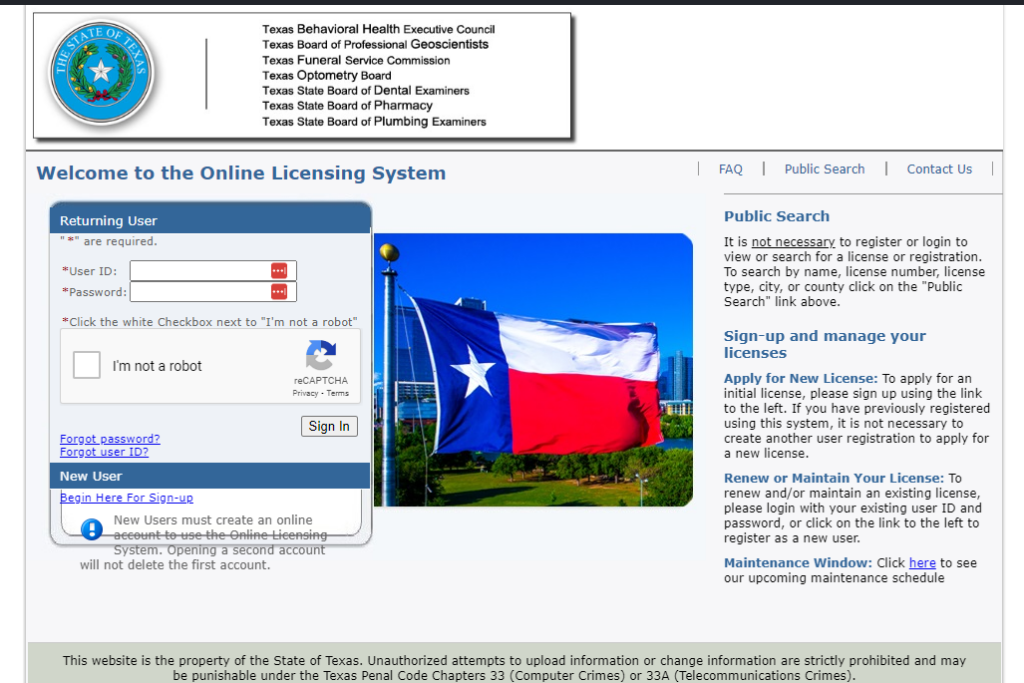

Step 3: Obtain Business Licenses and Permits

Do I need a license to sell online in Texas?

Depending on your online business activities, you may need specific Texas licenses, permits, and Seller’s Permits.

While internet businesses aren’t bound by physical location restrictions, you still must comply with Texas rules and regulations.

Not obtaining the necessary permits or licenses could lead to penalties or delays in launching your business.

Key items to consider:

Sales Tax Permit

If selling physical products in Texas, you need a Texas Sales and Use Tax Permit. This allows you to legally collect/remit sales tax. The basic process involves:

- Submitting Form AP-201

- Paying $39 permit fee valid for 2 years

Keep in mind:

- You may also need permits in other states if selling there

- No permit needed if ONLY selling digital products

Food Product Permits

Selling food items in Texas requires special licensing such as:

- Food manufacturer license – For making foods like baked goods or preserves to sell

- Food wholesaler license – For selling food to other businesses for resale

Professional Licenses

If your online business offers professional services in fields like healthcare, accounting, architecture etc., you may need special occupational licenses.

Use the License Search tool to look up your profession.

Zoning Permits

While entirely internet-based businesses have flexibility regarding zoning, check with your local municipality office if using part of your home for inventory storage, product manufacturing etc.

TLDR: Perform due diligence to determine which permits/licenses apply for your Texas online business activities and operational needs.

How long does it take to register a business in Texas?

The time it takes to register a business in Texas depends on a few factors:

1. Business Structure

- Sole Proprietorship: The simplest structure with the fastest “registration.” The main step is filing a DBA (Doing Business As) name with your county clerk, if necessary. This process can generally be completed within a few days or weeks.

- LLC, Corporation, Partnership: These structures require filing official documents with the Texas Secretary of State. The processing time depends on the filing method and whether you expedite the process.

2. Filing Method

- Online filing (SOSDirect): This is typically the fastest way to register an LLC or other formal business entity. Processing usually takes 3-4 business days.

- Fax or Mail: Paper filings and mailed submissions are slower. Expect approximately 30 business days for processing (10 business days if paying for expedited service).

3. Expedited Service

- Texas offers expedited processing for an additional $25 per document. Expedited submissions are generally processed by the close of business on the next business day following receipt.

Processing times can fluctuate based on the workload of the Secretary of State’s office.

If you make any errors or have incomplete documents, this will significantly delay your registration.

Step 4: Set Up Accounting and Taxes

Proper financial record keeping and tax compliance are key for any successful Texas online business.

Setting up the accounting correctly from the start minimizes headaches down the road.

Choose an Accounting System

Online accounting platforms allow easy income/expense tracking, payroll management, financial reporting and more:

| Platform | Highlights | Pricing |

|---|---|---|

| Quickbooks Online | Popular option packed with features | Starts at $25/month |

| Wave | Free option for basic accounting needs | Free |

| Xero | Tailored for online selling | Starts at $30/month |

Manually using spreadsheets or bookkeeping software are other options, especially for very small early stage operations.

Understand Sales Tax Collection

As covered in our licenses and permits section, if selling physical products to Texas residents, sales tax collection and filings apply:

- Texas sales tax rate = 6.25%

- Use monthly or annual reporting depending on revenue

- Consider sales tax automation software to simplify

File Business Taxes

Common Texas annual tax filings include:

- Formation documents for formal entities like LLCs and Corporations

- Texas franchise tax forms for LLCs and Corporations

- Self-employment tax like Schedule SE for income

- Texas sales taxes for physical goods sold

Consider working with a small business CPA to ensure full legal compliance.

Step 5: Build Your Website and Online Presence

A website sits at the core of nearly all modern online businesses.

Your website establishes credibility, allows customers to learn about your offerings, facilitates sales, and serves as a hub for all other online activities.

Additionally building out your online presence across social media bolsters discoverability and brand awareness.

Creating Your Business Website

Some website development approaches to evaluate include:

Website Builders: User-friendly drag-and-drop site creators like Wix or Squarespace get you online quickly. However, flexibility for complex needs is limited.

Hiring a Web Design Agency: Get a fully custom site designed but can be costlier for initial builds and modifications later. Ensure you fully own all site assets.

WordPress: Building on top of WordPress offers flexibility plus extensive CMS features. However, requires more web know-how vs turnkey site builders.

Whatever platform you choose:

- Secure a .com domain name matching your business

- Use search-friendly text, metadata and URL structures

- Enable SSL encryption for security and SEO

Social Media Profiles

In addition to your website, establish profiles representing your business on major platforms like:

- Facebook Business Page

- YouTube Channel

- Twitter account

- Instagram Business Profile

- LinkedIn Company Page

Social platforms help drive website traffic plus directly engage with your audience.

Having both an owned website as well as maintaining an active presence across social channels is key when establishing your broader online presence.

How much does it cost to start an online business in Texas?

The cost of starting an online business in Texas varies significantly depending on the specific nature of your business. Here’s a breakdown of the possible costs involved:

Essential Costs:

- Business Entity Formation:

- LLC (Limited Liability Company): The most popular option for online businesses, offering personal liability protection – costs $300 filing fee in Texas.

- Sole Proprietorship: The simplest (and cheapest) option if you’re running your business solo. No formal filing with the state is required, but you still need to register your business name if it’s different from your legal name. Cost varies by county.

- Domain Name: The cost of your website address (e.g., [www.yourbusinessname.com]([invalid URL removed])), typically between $10-$20 annually.

- Website Hosting: The service that stores your website files and makes it accessible on the internet – costs can range from a few dollars a month for basic plans to hundreds for more complex setups.

Potential Additional Costs:

- E-commerce Platform Fees: If you’re selling products online, platforms like Shopify or BigCommerce often have monthly fees or transaction fees.

- Inventory: The cost of products if you are selling physical goods.

- Professional Services: Lawyers, accountants, or web designers if you need professional expertise.

- Marketing and Advertising: Costs involved in promoting your business online through social media, paid advertising, etc.

- Business Licenses and Permits: Depending on your specific business activities, you might need additional licenses or permits. Check with your city or county.

Approximate Cost Ranges:

- Very Low-Budget Online Business: You could start a freelance service or consulting business with minimal costs (perhaps a few hundred dollars for registration and basic website setup).

- E-commerce Store: Expect to spend at least several hundred to a few thousand dollars for setup costs, initial inventory, and marketing.

Important Notes:

- Texas does not have a general state-level business license. Local permits or licenses might be required.

- While many online businesses can be started on a relatively small budget, investing more upfront allows for faster growth.

- Costs are always in flux. Research the current fees associated with any of the listed items.

Important Disclaimer: I’m not a legal or tax professional. It’s strongly recommended that you consult with a qualified tax advisor or attorney to ensure you remain compliant with all business and tax requirements in Texas.

Key Takeaways:

- Carefully weigh options like sole proprietorship vs LLC when choosing a business structure. Consider factors like liability, taxes and maintenance costs based on your specific business.

- Obtain an EIN and formally register your business name/DBA to establish a legal entity and permission to operate in Texas.

- Assess if you require special permits, licensing or zoning permissions depending on if and how you will manufacture or sell products. Perform due diligence.

- Set up proper accounting practices and understand tax implications like sales tax collection rules, self-employment tax and business tax return filings.

- Build a complete web presence encompassing an owned website as well as social media brand profiles. Treat your website as the hub that drives traffic to social profiles.

- Focus on creating search-friendly, well-crafted content that aligns with buyer needs and serves both users and search engines. Update regularly.

- Enable safe online payment collection early in your process to facilitate frictionless sales.

- Continuously monitor analytics for both your website and social channels while refining based on performance data insights.